The system is thus based on the taxpayers ability to pay. Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

How To Calculate Foreigner S Income Tax In China China Admissions

Corporate companies are taxed at the rate of 24.

. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income. If taxable you are required to fill in M Form.

Corporate Income Tax. Check out Complete Info on Tax Incentives for Labuan Expatriates and the Personal Tax Filing Procedure You can submit your tax filling personally via online thru hasilgovmy website. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers.

The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2019. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Personal income tax in Malaysia is charged at a progressive rate between 0 28. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a.

Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia for 5 consecutive YAs. On the First 5000 Next 15000.

Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of. 12 rows Income tax rate Malaysia 2018 vs 2017 For assessment year 2018 the IRB. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Calculations RM Rate TaxRM 0 - 5000. Inheritance Tax Rates In G7 And Eu Countries Ten Times Higher Than.

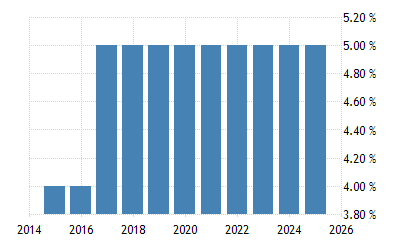

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. Malaysia personal income tax guide 2019 malaysia personal income tax rates malaysia personal income tax guide 2018 malaysia income tax guide 2017. Personal Income Tax Rate in Malaysia remained unchanged at 30 in 2021.

Things That Might Seem Tax Deductible but Actually Are Not. Malaysia Personal Income Tax Guide 2018 YA 2017 Calculating personal income tax in Malaysia does not need to be a hassle especially if its done right. Tax service only available for.

See also Evenflo Register Car Seat Canada. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Corporate tax rates for companies resident in Malaysia is 24.

For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24. Based on this amount the income tax to pay the government is RM1640 at a rate of 8per cent. On the First 5000.

Malaysia Personal Income Tax Rate The Personal Income Tax Rate in Malaysia stands at 30 percent. Rate TaxRM A. As a non-resident youre are.

Read Personal Income Tax Rebate and Personal Income Tax Relief for details. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Income attributable to a Labuan business.

Inland Revenue Board of Malaysia 10Y 25Y 50Y MAX Chart Compare Export API Embed Malaysia Personal Income Tax Rate. Tax Rate Tables 2018 Malaysia. The latest Personal Tax Rate for the resident is as follows.

13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018. Income Tax in Malaysia in 2019.

Resident individuals are eligible to claim tax rebates and tax reliefs. 20182019 Malaysian Tax Booklet Personal Income Tax 20182019 Malaysian Tax Booklet 24 2. Read on to learn about your income tax rate and filing your 2018 personal income tax with LHDN.

Data published Yearly by Inland Revenue Board. Historical Data by years Data Period Date Historical Chart by prime ministers Najib Razak Abdullah Badawi Personal Income Tax Rate in Malaysia by prime ministers. On the First 5000.

Here are the progressive income tax rates for Year of Assessment 2021. The maximum rate was 30 and minimum was 25. Assessment Year 2018-2019 Chargeable Income.

Based on your chargeable income for 2021 we can calculate how much tax you will be paying for last years assessment.

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

U S Estate Tax For Canadians Manulife Investment Management

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Why It Matters In Paying Taxes Doing Business World Bank Group

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Eritrea Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

How Train Affects Tax Computation When Processing Payroll Philippines

Income Tax Malaysia 2018 Mypf My

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Income Tax Malaysia 2018 Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysian Bonus Tax Calculations Mypf My

2018 2019 Malaysian Tax Booklet

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia